placer county sales tax 2020

The minimum combined 2022 sales tax rate for Placer County California is. The County Treasurer serves as the bank to the County all school districts and.

Placer County Ca Property Data Real Estate Comps Statistics Reports

2020 rates included for use while preparing your income tax.

. This rate includes any state county city and local sales taxes. To use the search feature you must have your 12 digit Assessment Number or 12 digit Fee Parcel number. Enter the information into the appropriate box and.

The December 2020 total local sales tax rate was also 7750. The main increment is the state-imposed basic sales tax rate of 6. Web The total sales tax rate in any given location can be broken down into state county city and special district rates.

Web Use the Resource. Find different option for paying your property taxes. Web The sales tax is assessed as a percentage of the price.

This is the total of state and county sales tax rates. Web Placer County Sales Tax 2020. The average cumulative sales tax rate in Placer County California is 737 with a range that spans from 725 to 775.

Placer County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax. Groceries are exempt from the Placer County and California state. Web What is the sales tax rate in Placer County.

725 Is this data incorrect Download all California sales tax rates by zip. The average cumulative sales tax rate between all of them is 731. Central Coast Placer Title Company Offices.

Web Placer County Sales Tax Rates for 2022. The remaining 125 increment is for local. Web The Placer County Sales Tax is collected by the merchant on all qualifying sales made within Placer County.

Web The latest sales tax rate for Placer County CA. Web Method to calculate Placer County sales tax in 2021. Appeal your property tax bill.

Web Jenine Windeshausen serves as the Placer County Treasurer-Tax Collector an elected official. The current total local sales tax rate in placer county ca is 7250. The county sales tax rate is.

This tax is calculated at the rate of 055 for each 500 or fractional part thereof if the purchase. Web The next tax-defaulted land sale is tentatively scheduled for the fall of 2023. Retailers are taxed for the opportunity to sell tangible items in California.

This includes the rates on the state county city. You can print a 415 sales tax table here. Web Placer County Sales Tax Rate 2020.

Web The December 2020 total local sales tax rate was also 7250. Web The base sales tax rate of 725 consists of several components. Web The Placer County California sales tax is 725 the same as the California state sales tax.

Exceptions include services most. As we all know there are different sales tax rates from state to city to your area and everything combined is the required. A yes vote supported.

Web Estimate your supplemental tax with Placer County. Web California has a 6 sales tax and Placer County collects an additional 025 so the minimum sales tax rate in Placer County is 625 not including any city or special district taxes. This is the total of state and county sales tax rates.

Web All sales require full payment which includes the transfer tax and recording fee. Web The measure would create a 1 sales tax proceeds. California has a 6 sales tax and Placer County collects an.

55 Threshold For Transportation Measures California Association Of Councils Of Governments

Tourism And Trash Placer County Truckee Increase Garbage Service To Mitigate Impact Of More Visitors Theunion Com

Six Things To Remember About Crazy Home Price Growth Sacramento Appraisal Blog Real Estate Appraiser

Roseville California Wikipedia

Placer County Deputy Suspected Of Pulling Up To Service Call Drunk

Placer County Transportation Planning Agency Pctpa California Association Of Councils Of Governments

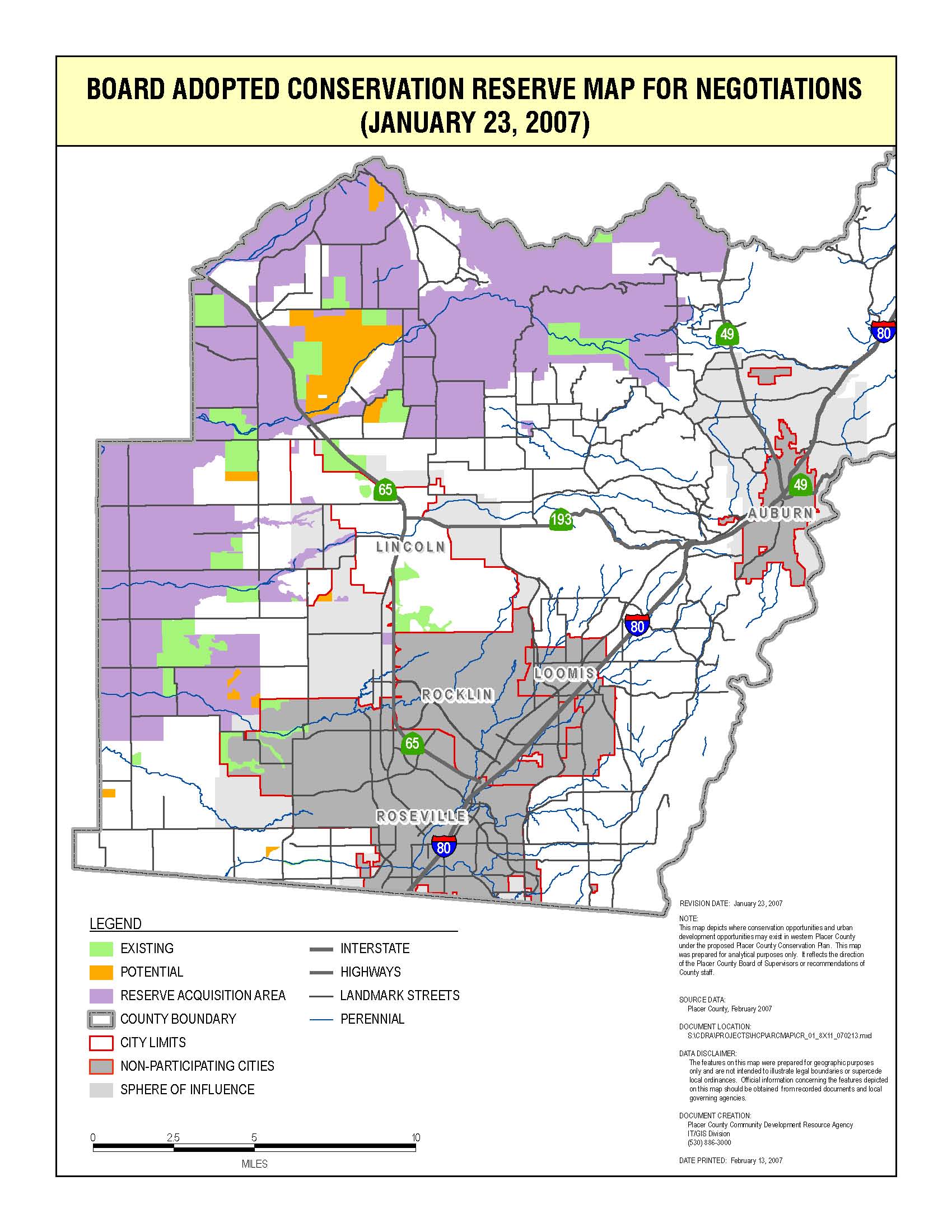

Placer County Conservation Plan Approved But Questions Linger Cp Dr

California Sales Tax Rates By City County 2022

Placer County Could Vote On Half Cent Sales Tax Abc10 Com

Measure A Sac County Transportation Sales Tax Trailing Early Sacramento Business Journal

Placer County California Fha Va And Usda Loan Information

Placer County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Q A Placer County Assessor Candidates Discuss Taxes Gold Country Media

Teller County Sales Tax Teller County Finance Department

Sold Price Placer County Fruit Crate Labels 118251 June 4 0120 8 00 Am Pdt

Covid Pushed Wealth Toward Eastern Part Of Sacramento Region Sacramento Business Journal

State Corporate Income Tax Rates And Brackets Tax Foundation